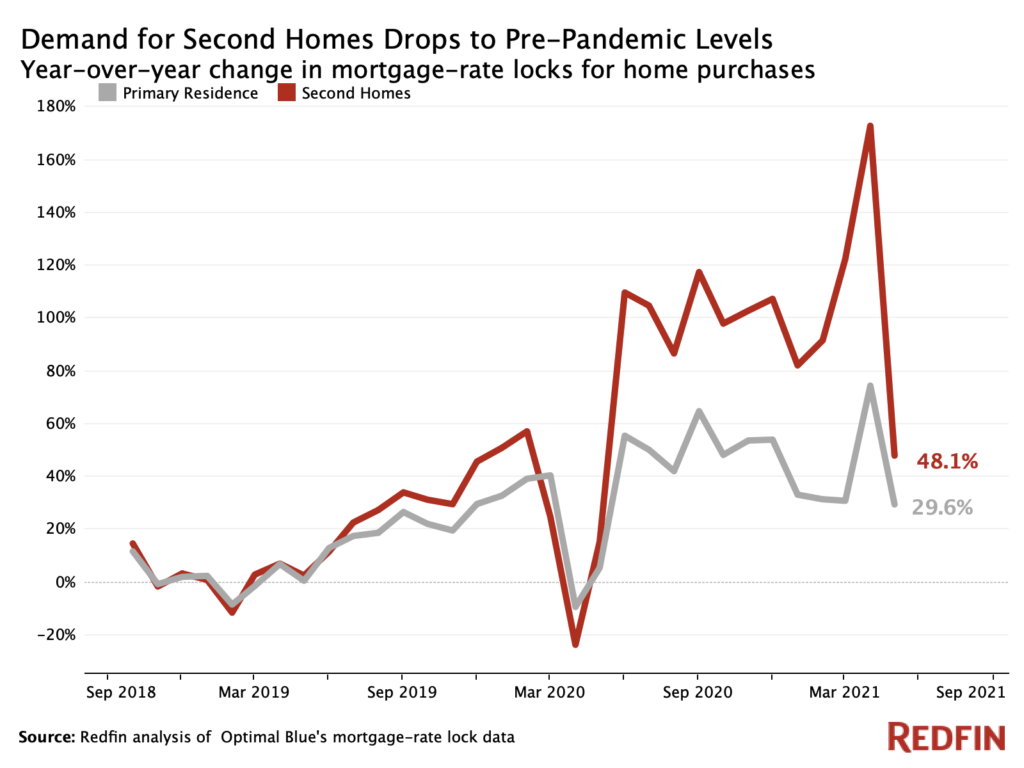

Though mortgage-rate locks for second homes were up nearly 50% year over year in May, the growth rate is returning to pre-pandemic levels as high prices and tighter lending rules make vacation-home buyers think twice.

The number of buyers who locked in mortgage rates to purchase a second home nationwide rose 48% year over year in May. Though that’s a significant increase, it’s the first time in a year the annual growth rate has fallen below 80%. Year-over-year increases in this report are likely exaggerated because demand for second homes was relatively low in May 2020 due to the coronavirus pandemic slowing real estate activity.

Demand for vacation homes jumped in June 2020 as the U.S. real estate market came roaring back to life, with a 110% year-over-year increase in second-home mortgage locks, and the level remained elevated through April. The annual increase in May is similar to pre-pandemic levels.

The number of buyers who locked in mortgage rates for primary homes rose 30% year over year in May.

The data in this report is based on a Redfin analysis of mortgage-rate lock data for home purchases from real estate analytics firm Optimal Blue. A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a second home or an investment property. Roughly 80% of mortgage-rate locks result in actual home purchases.

There are several reasons for the cooling in second-home demand this spring. High prices are likely playing a role, as is the reopening of offices. The typical spring slowdown in overall pending home sales is also impacting vacation-home sales. Plus, many people with the desire and means to buy a vacation home this year have already done so throughout the pandemic.

Additionally, mortgage-lending rules for second homes tightened in April and May. Under new federal rules, second-home and investment property mortgages can make up just 7% of a lender’s total pipeline. That’s on top of regulations that make it difficult to get a loan for condo towers in resort areas that may be used as short-term rentals.

“In addition to tighter lending rules, vacation-home buyers are starting to react to rising prices,” said Redfin Chief Economist Daryl Fairweather. “Home prices have been climbing rapidly for the last several months, and it seems they’ve finally gotten prohibitively high for some people searching for second homes. Vacation-home buyers are quicker to back away from properties that are potentially overpriced because they’re not a necessity. People searching for primary residences may have to shell out more money than they want to because they need a roof over their heads.”

“A lot of the people who were driven to hunt for vacation homes over the last year have already bought them,” Fairweather continued. “The pandemic and remote work drove many affluent Americans to relocate to vacation destinations, at least part of the time. But with offices reopening and life returning to some semblance of normal, people are less focused on fleeing to the beach or the lake.”

United States

United States Canada

Canada